Three new factors are likely to accelerate the digitalization of sports:

Ownership: Institutional capital – including funds managed by private equity firms, sovereign wealth funds and family offices – is increasing investments in sports assets. This may result in more funding to support the digital transformation of the industry and lead to better returns.

Demographics: Younger audiences not only expect more digital entertainment options: They are more willing to increase spending on digital sports content, which creates an incentive to tap that demand.

“To better compete for viewing time, we think the sports industry needs to adopt technology to better match different preferences of younger audiences, which rely more on social media and non-live formats than older peers,” Medina says.

Distribution: Some major names in technology are successfully getting involved in transmission rights of sports events. This trend could push digitalization and turn regional games and competitions into global brands.

Sports’ ‘Scarcity Premium’

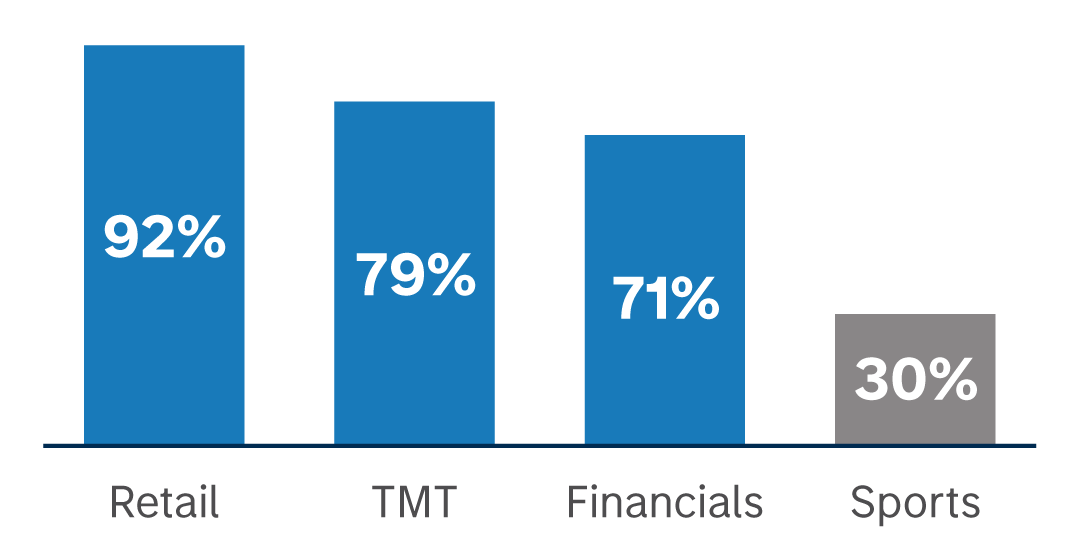

Morgan Stanley Research estimates that generative AI could reduce TV and film production costs by up to 30% and rapidly extend the supply of non-live entertainment. In contrast, sports mostly offer limited and unique live content, generating a “scarcity premium” that drives increasing viewership across different categories and geographies. Sports audience growth vastly surpasses other forms of media and entertainment content.

“The advantage of having a ‘scarcity premium’ could be amplified if the sports industry were to use personalized marketing at the same level of other industries,” Medina says. “We also note that, unlike major cinema or music hits, sports leagues tend to concentrate their revenues on domestic audiences, suggesting that sports franchises are not properly monetizing the global following of individual stars participating in their leagues.”

Opportunities for Growth

Technology could help sports boost their main sources of revenue. Events sales, which account for nearly half of the industry’s total revenue, could rise 21%. For example, AI would help boost attendance and sales by adjusting ticket prices to weather conditions, league standings and popularity of teams and players. Some smart venues are using facial recognition for faster entry and purchases.

Morgan Stanley estimates that media revenues, which include distribution rights, could expand 36% from higher digitalization. Technology could make broadcasting more interactive and personalized, leading to higher viewership and better monetization. In recent years, Formula 1 has been deploying AI and machine learning to analyze historical data and deliver real-time insights and predictions to its audience during live broadcast. As a result, video views on F1’s digital platforms have jumped 40%.

Revenue from fan engagement activities, which include fantasy sports, betting and video games, could rise 23%, by making the content more detailed, personalized and interactive.

A Morgan Stanley AlphaWise survey of 2,000 consumers in the U.S. in the first quarter of 2025 showed that fans under 35 are the largest group likely to spend more money on sports if the experience is digital-first.

“Global sports are no longer just about what happens on the field: It’s about how fans experience it—on their phones, in their homes, and in the stadiums of the future,” Medina says. “So, whether you’re an investor, a fan, or just someone who loves a good underdog story, this is a game worth watching.”

For deeper insights and analysis, ask your Morgan Stanley Representative or Financial Advisor for the full report, “Global Sports: Scoring in the Digital Age,” (July 24, 2025).