The year ahead brings an unusually broad range of possibilities for inflation and global growth. Global gross domestic product (GDP) is likely to moderate to an estimated 3% (4Q/4Q) in 2025 and 3.2% in both 2026 and 2027, while inflation cools across different regions, allowing policymakers to reduce interest rates further, according to Morgan Stanley Research.

Strong household finances and growing wealth are keeping Americans spending. At the same time, businesses continue to invest in AI, even as the pace of those investments starts to level off.

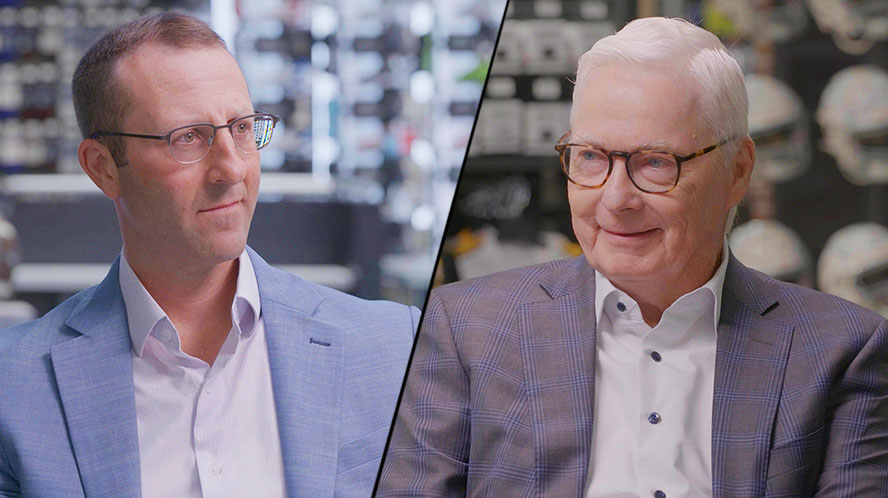

“These two factors—strength in consumption and business spending—were why we never called for a recession early in 2025, when markets pulled back on trade policy fears,” explains Seth Carpenter, Morgan Stanley’s Chief Global Economist. “The U.S. remains the most likely economy to drive material upside to global growth.”

However, uncertainty remains high and the range of possible outcomes is wide: On one hand, consumer demand or AI-driven productivity could boost growth above the baseline forecast; on the other hand, the U.S. economy could be hit harder than expected by issues including monetary policy, tariffs and immigration.

“The exact path depends on the strength of the consumer amid a slowing labor market and when AI adoption increases productivity gains meaningfully,” Carpenter says.

Varying Levels of Growth in U.S., China and the Eurozone

Looking beyond global numbers, the U.S. economy may slow notably in the first two quarters of 2026, but reaccelerate in the second half—helped by momentum in consumer and business spending, along with easier monetary and fiscal policy—to reach 1.8% real growth in GDP in 2026 and 2.0% in 2027. The potential for growth picks up as AI adoption drives productivity increases.

China’s real GDP is forecast to expand 5% in 2026, helped by front-loaded government policy support, followed by 4.5% in 2027 as the effect of fiscal stimulus wanes. Growth in the euro area is likely to remain moderate at 1.1% in 2026 and 1.3% in 2027 as German fiscal support is partially offset by consolidation in France and Italy.

The Disinflation Trend

The continued slowing of inflation is a global trend. In the U.S., the core personal consumption expenditures (PCE) index, which the Federal Reserve watches closely, is forecast to rise in the first quarter of 2026 because of tariffs and immigration restrictions before resuming its gradual descent. Core PCE is forecast to be at 2.6% at the end of 2026 and 2.3% at the end of 2027.

In the euro area, the outlook is for headline inflation to undershoot the European Central Bank (ECB) target of 2%, with the economy running below its potential. Inflation is expected to run 1.7% at the end of 2026 and in 2027.

In Japan, headline and core inflation have been above target for the past couple of quarters, but the underlying trend has been weaker, prompting a forecast for inflation to edge below 2% in late 2026 and then rise back to policymakers’ 2% target in 2027. In China, core CPI inflation is likely to be positive, but the GDP deflator is expected to hover below 0% as the economy’s excess capacity dissipates only gradually.

Rate Cuts Across Regions

Given the benign inflation picture, monetary policy is forecast to move toward neutral across key economies. The Fed is likely to reduce rates through April, assuming that job growth in the U.S. is slow and any rise in core inflation is modest. The forecast expects an extended pause when the Fed’s target rate is at 3%-3.25%.

“Even with the transition to a new Fed Chair in the second quarter of 2026, we expect the Fed’s reaction function to be roughly unchanged as most of the Committee itself will remain in place well into 2027,” Carpenter says.

The ECB has communicated that it plans to hold interest rates where they are. However, with slow growth and slack in the euro zone economy, and with inflation below target, the forecast is for two rate cuts in 2026, bringing their policy rate down to 1.5% by midyear. The Bank of England, on evidence of a softening economy and lower inflation, is forecast to bring rates down to 2.75% in 2026 before pausing.

The Bank of Japan, the only major developed market central bank that is hiking rates, is likely to increase its policy rate to 0.75% in December in the baseline forecast, and then remain on hold in 2026. Rate hikes may resume in 2027 and bring the policy rate to 1.25%.

Weighing Alternative Scenarios

The outlook for the global economy is uncertain, and much depends on what happens in the U.S. If U.S. growth surprises to the upside, other countries could benefit too. But if the U.S. slows down more than expected, there’s a chance of a mild recession that could ripple across the world.

There may be demand-driven upside for U.S. growth. In this scenario, U.S. households and upbeat businesses—boosted by recent government spending and tax changes—could ramp up their investments. This could drive real U.S. GDP above 3% in 2026.

A productivity-driven scenario is based on the possibility that adoption of AI could accelerate and its impact on the economy occur more quickly than expected. If productivity gets a big boost, the economy could grow faster than expected—even as prices stay low. Under this scenario unemployment holds steady in 2026, with businesses needing somewhat fewer workers, but without widespread job losses.

The scenario of a mild recession in the U.S. could adversely affect growth elsewhere, including Europe, Japan and China. The possibility is based on greater-than-expected slowing in the U.S. economy due to lagged effects from monetary policy, tariffs and immigration restrictions. If this occurs, real GDP growth quarter-on-quarter could turn negative in the first half of 2026 and unemployment could rise. In this scenario, the Fed eases but doesn’t go to zero because the contraction is mild.