Geopolitical tensions—coupled with the COVID-19 pandemic—have contributed to deglobalization, setting the scene for a broader world order: multipolarity.

In 2019, Morgan Stanley Research outlined how secular trends and trade tensions were, together, slowing globalization and potentially reversing it, in a concept that’s been referred to “slowbalization.”

One year later, this idea of slowbalization is no longer theoretical. Geopolitical tensions—coupled with the COVID-19 pandemic—have contributed to, and been exacerbated by, an about-face in globalization. This trend could pave the way for a new economic dynamic called multipolarity, which would have significant impact on global business strategy and the investment landscape.

“In a multipolar economic world, we’ll see groups of nations with enough influence and incentive to pursue economic strategies that, if achieved, do not substantially follow the same direction of other global power centers," says Michael Zezas, Head of U.S. Public Policy Research.

In a recent Bluepaper, a cross-section of the firm's equity strategists, economists and policy experts—in coordination with AlphaWise, the proprietary survey and data arm of Morgan Stanley Research—examined the implications of this shift and created a framework for investors to gauge its impact on individual companies.

“It turns out that this multipolar world is far more complex than the shorthand narratives of de-globalizing or decoupling," says Reza Moghadam, Chief Economic Advisor. “In our framework, the U.S. and China will increasingly compete directly in multiple spheres ranging from technology, security, health policy, financial markets, and corporate governance."

The Risk/Reward Nexus

While it's impossible to make sweeping generalizations about the realities of a broader world order, multipolarity tends to favor companies and sectors whose supply chains are not globally complex and whose products and services don't pose a threat to economic or national security. Even better positioned are companies that could become stronger regional champions, with services key to national interests and perhaps better protected from competitive pressures.

Conversely, companies, industries and sectors that have globally integrated supply chains, especially those with technology and health security liabilities, could be increasingly vulnerable to multipolar trade and national or economic security policy trends.

Perfect Storm for Multipolarity

While many factors are contributing to multipolarity, increasing rivalry between the U.S. and China is one of the most visible drivers.

Although the U.S. and China struck a trade agreement in early 2020, implementation has been partial and non-tariff barriers have continued to rise. The outbreak of COVID-19 has only added to tensions between the two nations. More recently, the Trump administration has instructed the Commerce Department to block transactions involving information or communications technology, namely from China, that pose a risk to critical infrastructure, the digital economy, or national security.

The upcoming U.S. election may not change these dynamics. “While the current administration may have taken stronger actions toward China than its predecessors, U.S. voter skepticism about China has been rising on a bipartisan basis for many years," says Zezas.

A cascade of other events creates additional barriers. Over the past three years, the U.S. has pulled out of several high-profile multilateral agreements. At the same time, more voices are rejecting the U.S. veto and outsized EU influence at the World Trade Organization, the World Bank and International Monetary Fund.

All of these conditions contribute to a multipolar world, where no single nation calls the shots. At the same time, the U.S. and China increasingly compete in multiple spheres, and other nations—including Europe, Japan, and indeed the rest of the world—will be vying for their own influence and economic opportunities.

Morgan Stanley's Alphawise survey suggests U.S. voters remain skeptical of China

Pandemic Deepens the Divide

Although these trends were impacting global supply chains before the arrival of COVID-19, the pandemic has raised new concerns about economic self-sufficiency and security—among both among policymakers and corporate decision makers.

In the U.S., some policy proposals include: expensing for capital expenditures to incentivize supply chain localization, bringing home the manufacturing of crucial pharmaceutical ingredients and requiring government agencies to procure all of their medical supplies from exclusively American manufacturers.

At the corporate level, Morgan Stanley's AlphaWise survey indicates that companies are themselves rethinking their supply chains, in part because of concerns around COVID-19 and trade tensions.

“At a minimum, the concerns around health security suggest that companies could seek to geographically diversify their overseas supply chains, and governments may be willing to adopt policies to facilitate this transition. Interestingly, onshoring and nearshoring looks most advanced among U.S. companies, with European and Asian companies still tending towards globalization,” says Jonathan Garner, Chief Asia and Emerging Markets Equity Strategist.

Morgan Stanley's Alphawise survey suggests a meaningful amount of end-market change from organic and new market revenue growth alongside COVID-19 and trade tension issues

The Rise of Regional Champions

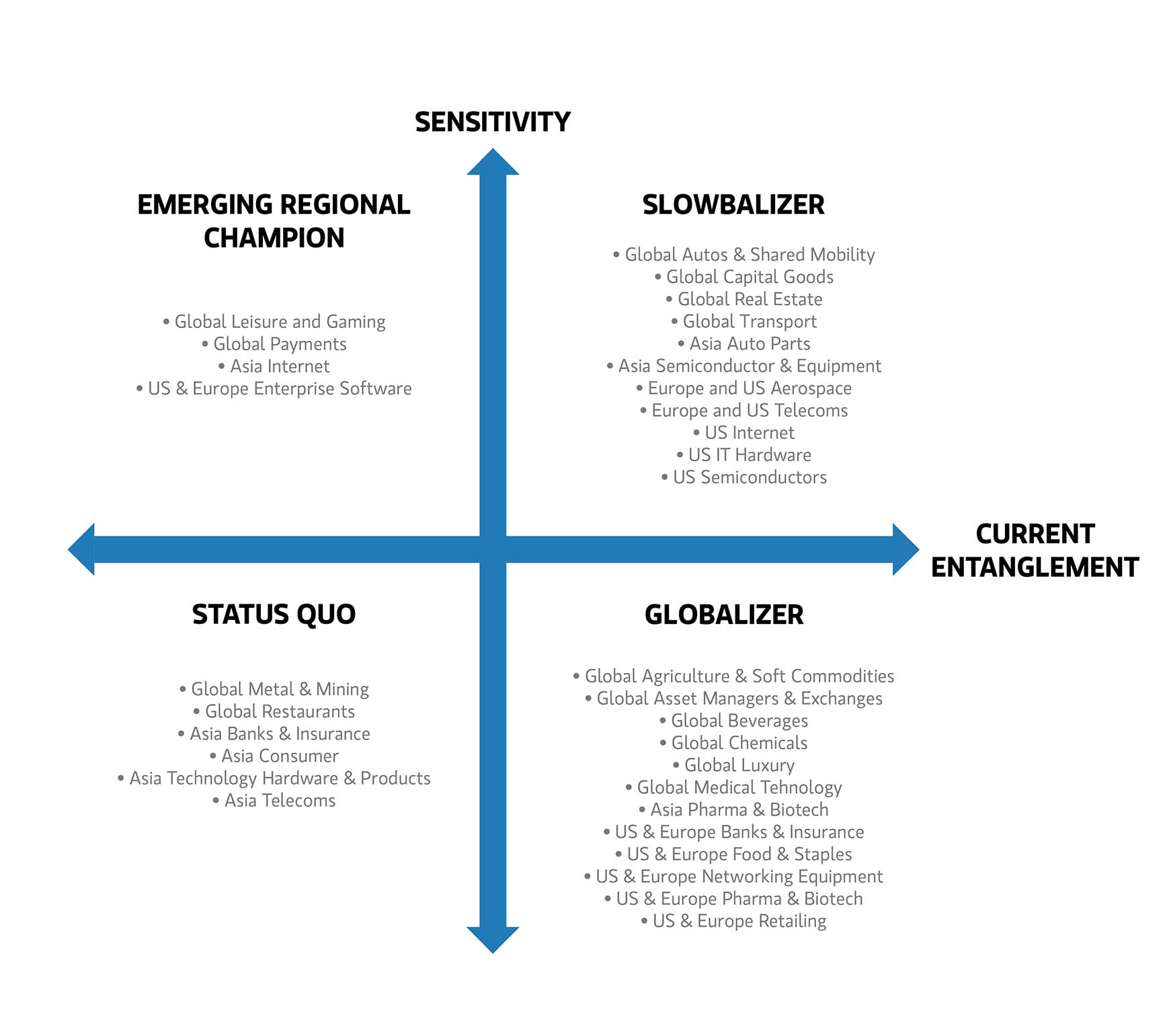

To make sense of the transition to a multipolar structure, Morgan Stanley analyzed 35 global/regional sectors comprising more than 500 companies based on two key variables—sensitivity and entanglement—and assigned them to one of four quadrants: Emerging Regional Champions, Globalizers, Slowbalizers and Status Quo.

Morgan Stanley's equity analysts have mapped 35 sectors that stand to benefit—or see headwinds—from the emerging multipolarity trend

Emerging Regional Champions could benefit from a growing divide. These are companies whose industries or products are sensitive to economic or national security of their home countries but aren't reliant on foreign markets of geopolitical rivals. At the sector level, these winners include Asian internet companies, leisure and gaming, payments, and U.S. and European enterprise software.

Contrast this to Slowbalizers—companies that rely on sensitive technology and supply chains that are globally diffuse. “They face higher cost pressures and even in some cases shrinking addressable markets over time," notes Daniel Blake, Asia and Emerging Markets Equity Strategist. While individual companies are more vulnerable than others, Slowbalizers include: Asia and U.S. semiconductors, U.S. internet and IT Hardware, autos, shared mobility and transportation, among others.

A third segment, Globalizers, sit in industries where the products and production processes are not sensitive, though they do benefit from globalized supply chains, revenue and outsourcing. Apparel is a prime example, but it's hardly alone; beverages, luxury goods, media and entertainment, and U.S. and European financials fall into this group. “Of the 35 sectors assessed, we found that 13 don't have sensitive products and are still pursuing international growth or increased supply-chain outsourcing," says Blake.

Finally, there is the Status Quo segment for industries where products and production processes are not critical to national or economic security, and their production does not benefit from an overseas supply chain. These include global restaurants, Asia consumer and Asia telecoms. However, the report notes that overall, 80% of sectors are in a category other than status quo, which means the multipolar theme could have a material bearing on the global earnings and valuation outlook.

For Morgan Stanley Research on multipolarity, including access to an interactive tool which maps corporate supply chain and geographic revenue linkages across listed global equities, ask your Morgan Stanley representative or Financial Advisor for the full report, “Investing For a Multipolar World" (Jun 23, 2020).