Required minimum distributions (RMDs) are likely to play an important role in your finances in retirement. Planning ahead for what you want to do with the money may help reduce taxes and increase options for re-investing. Here’s 8 things you should know.

1. What is an RMD?

If you have a Traditional, Rollover, SEP, SAR-SEP, or SIMPLE IRA, the Internal Revenue Service (IRS) requires you to withdraw a RMD from the account by December 31 each year, beginning the calendar year in which you turn the “RMD age” below:

- 70 ½ (if you were born before July 1, 1949),

- 72 (if you were born after June 30, 1949, but before 1951),

- 73 (if you were born after 1950, but before 1960), or

- 75 for all others (note, there is an apparent drafting error in the statutory language, which makes it unclear when age 75 starts to apply in lieu of age 73, but it appears age 75 is intended to apply if you were born after 1959).

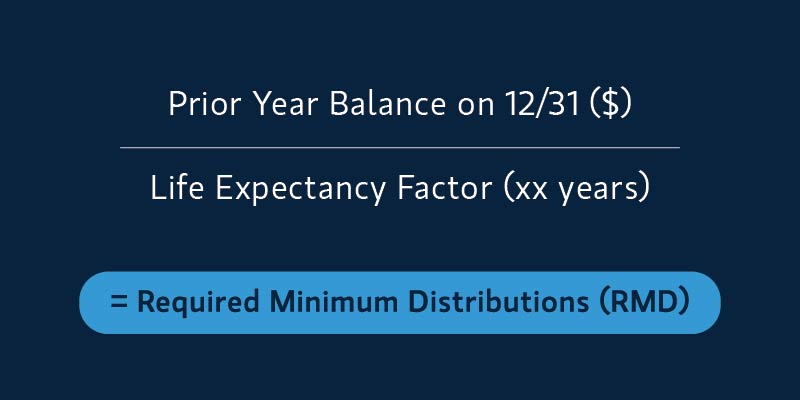

2. How is the RMD calculated?

In general, to calculate your RMD, you divide the prior year’s account balance by the applicable IRS life expectancy factor based on your age that year. If you’re a Morgan Stanley Virtual Advisor (MSVA) client, visit the Balances page located under the Accounts tab on Morgan Stanley Online to see your estimated RMD amount.

Your life expectancy factor is taken from the Uniform Life Expectancy Table which assumes that RMDs are based on the lives of an IRA owner and a beneficiary who is 10 years younger. However, if your spouse is the sole primary beneficiary for the entire calendar year and your spouse is more than 10 years younger than you, you may elect to use the Joint Life Expectancy Table. Your marital status is determined as of January 1 of each distribution calendar year and, therefore, changes in marital status (such as the death of your spouse) occurring after January 1 generally will not prevent your spouse from being considered the sole beneficiary of your IRA for that year.

3. When should I take my RMD?

In general, the deadline for taking RMDs is December 31 each year. You may want to consider taking your RMD sooner than later to help avoid potentially penalty taxes for failure to timely take the RMD. However, you may delay taking your first RMD (and only your first RMD) until April 1 of the year after you turn the RMD age. If you choose to delay your first RMD, you'll have to take your first and second RMD in the same year (which could result in unintended tax consequences, e.g., push you into a higher tax bracket on a portion of your taxable income for the year).

4. What if I forget to take my RMD?

Forgetting to take an RMD or receiving the full amount may result in the IRS imposing a penalty tax on the amount not distributed as required. If you fail to take an RMD or don’t take enough, you should consult with and rely on your own tax advisor to determine what remedial steps you should take to address such failure.

5. What can you do with the RMD money you may not need right away?

Let’s say your pension or other income has already got your expenses covered for the year. If that’s the case, here are some ideas about how you might want to put that RMD to work for the future.

- Reinvest in a taxable brokerage account

- Contribute to a 529 Education Savings Plan for a grandchild or loved one

- Use it towards a major purchase like a vacation, new car, new roof or even a more energy-efficient furnace

- Make a charitable donation through a qualified charitable distribution (QCD)*

6. Do I have to take my RMD from my Traditional, SEP, or SIMPLE IRA if I’m still working?

You must withdraw this amount by April 1 of the following year, even if you’re still working. You’re then required to take another withdrawal from your IRA by December 31 of that year and every year thereafter. If you own a Roth IRA, RMDs don’t apply during your lifetime (but RMDs do apply after your death). The qualified retirement plan rules regarding RMDs are different so check with your plan administrator to determine when you are required to take an RMD.

7. If I own multiple IRAs, can I take the RMD from one IRA without disturbing the others?

You must calculate your RMD for each IRA separately. Then, you can withdraw an RMD from each account, or you can add up the RMD amount from each IRA (you cannot include RMDs from 401(k) plans or aggregate with Qualified Plans) and withdraw the aggregate amount from only one IRA (other than Roth IRAs or Inherited IRAs). You may consider consolidating IRAs subject to an RMD into one account. Then you’ll only need to calculate and withdraw an RMD from one account each year.

8. How can MSVA help with my RMDs?

As a MSVA client, we can provide you information to help you understand your RMDs and provide guidance to help you use the RMD amount distributed from your IRA to pursue your financial goals.

When you’re ready to take action, schedule a meeting with us today. Already a client? Schedule a Conversation. Not yet a client? Schedule an Introductory Call.