If you’re investing, saving money for retirement and paying down debt, you probably feel good about your financial future. That said, even the most experienced investors can have a hard time shaking the feeling that they’re making it up as they go along. And when uncertainty strikes in the form of a market decline, job loss or unexpected expenses, anxiety and worry are never far behind. That’s where a financial plan comes in.

A financial plan aligns your goals with your tolerance for risk and the amount of time you have until major goals such as retirement, while giving you the adaptability to manage whatever life throws your way. Think of it like a roadmap: It can tell you where to go, along with alternative paths to take when you run into a detour or decide to take the scenic route.

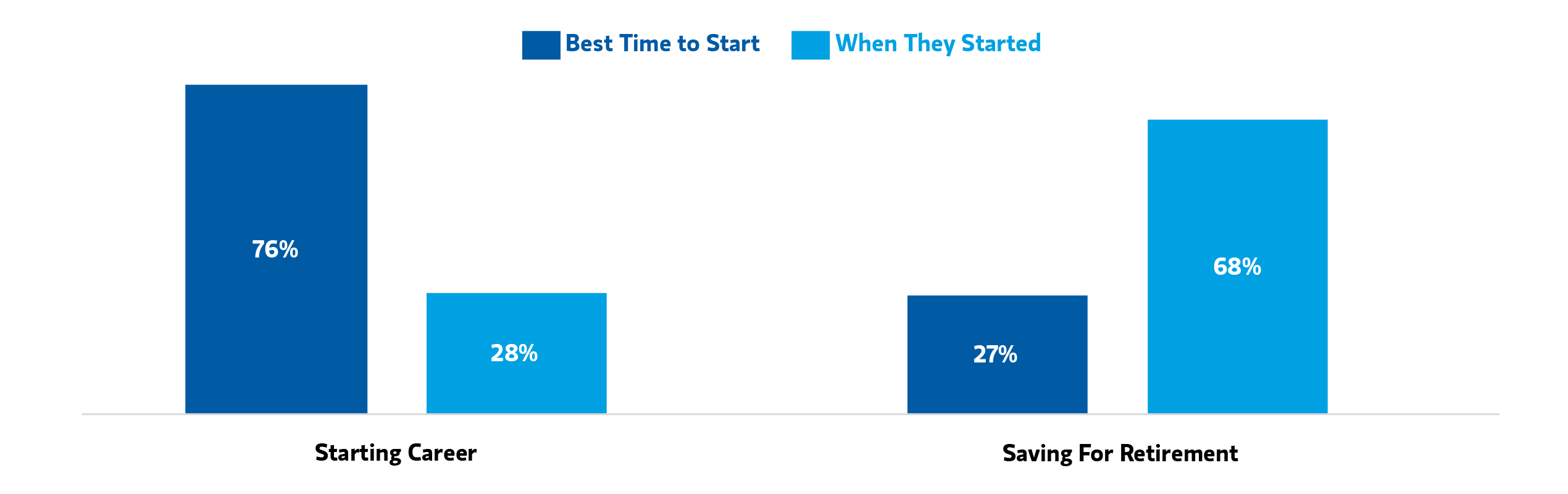

To better understand the value of financial planning, Morgan Stanley Wealth Management’s Global Investment Office polled more than 1,000 respondents to understand financial planning trends among today’s investor population for our 2025 The Power of Financial Planning Survey.1 Three-quarters (76%) of respondents said they wish they had had a financial plan sooner and 66% reported feeling a lack of strong confidence in their ability to achieve long-term goals.

Creating a financial plan as early as possible can help you feel prepared, no matter what. Here’s how to get started.

What is a financial plan?

A financial plan is more than just an investment strategy. It is a personalized roadmap that can help you make decisions about financial tradeoffs and manage your money throughout your life. With the help of a Financial Advisor, you’ll review your assets, such as your investment portfolio; consider your liabilities, such as debt; and discuss your personal goals. Those details can help you create a step-by-step plan that will map out your timeline to achieve short- and long-term goals.

For example, your plan can help you determine how you’ll save to buy a home in a way that considers the market and interest rate environment. Or it might account for the way a career pivot or earlier retirement date may change your savings goals. You can also model what-if scenarios so you’re prepared for the things that keep you up at night, for example, inflation or loss of a family member. Modeling different scenarios can help you be more informed and confident about the decisions you make.

Why do I need a financial plan?

Like any roadmap, a financial plan can help you avoid feeling stressed. According to our research, people with a financial plan are less likely to worry about whether they are on track to meet their financial goals (36% of survey respondents) compared to people without a financial plan (47%). At the same time, respondents with a financial plan are about 10% more likely to say they are satisfied with their personal relationships, investment portfolio, life direction and financial health.

/extrawide_3x1-wide-podcast-WSIDWMM-2540x800.jpg/_jcr_content/renditions/wide_16x9-wide-podcast-WSIDWMM-2540x800.jpg)