The Impact on Jobs

Technological revolutions—from electrification to the internet—have historically reshaped work, altering job types and employment levels. While concerns persist that AI could displace millions of jobs and increase unemployment, history points to the potential for net positive effect on job growth, though that could come with an unprecedented demand for re-skilling.

“Each wave of technological transformation has brought both disruption and opportunity,” says Morgan Stanley U.S. Economist Heather Berger. “We expect AI to do the same: While some roles may be automated, others will see enhancement through AI augmentation, and AI is likely to create entirely new roles.”

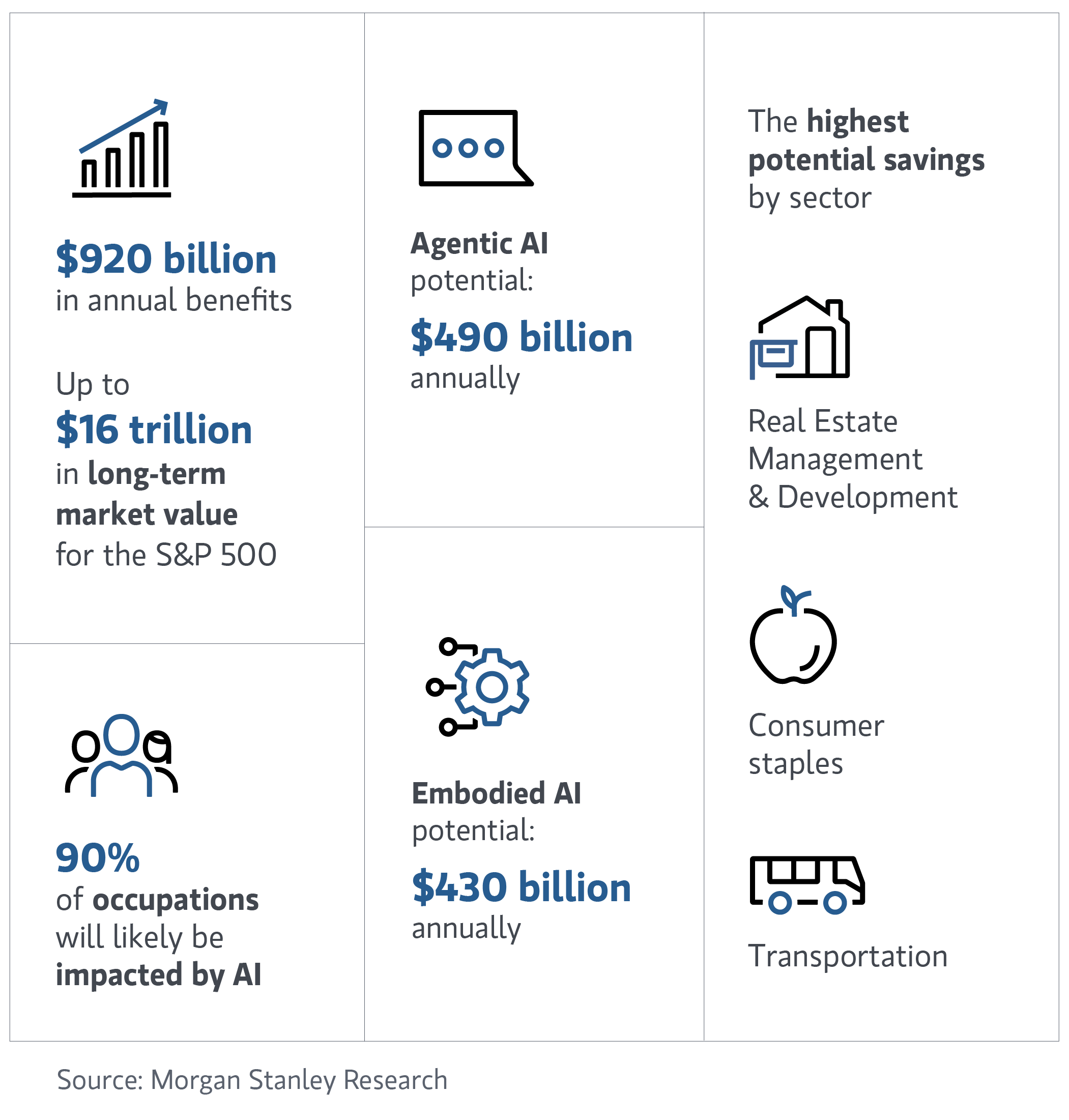

Agentic AI is likely to affect a broader range of occupations than the deployment of humanoids. However, that doesn’t mean agentic AI will lead to greater job losses. Instead, it could shift work toward higher-value tasks and create more positions. In contrast, embodied AI, while impacting fewer roles, carries a higher likelihood of automation and displacement.

Companies are already preparing for this shift by creating executive-level roles, such as Chief AI Officer, responsible for guiding AI adoption and aligning it with business goals. As AI systems take on more decision-making responsibilities, organizations will also need to expand roles in data governance, compliance, policy, and information security.

“We are bullish on the potential for significant additional employment in entirely new professions made possible by AI augmenting human capabilities and unlocks entirely new sources of value and revenue,” Berger says.

Assessing AI Adoption in Investment Portfolios

As a transformative force that can unlock new sources of growth, productivity and innovation across industries, AI is not only powerful, but it evolves at an exponential pace. Data from the past six years show that AI capability improvement is doubling every seven months. Investors should watch this closely as AI progress has direct implications on value creation for companies.

“Investors should assess AI adoption potential across their portfolios now, as we are seeing signs of inflection,” Byrd says. “Additionally, there’s strong evidence suggesting that the pace of AI capability improvement is non-linear, and we believe investors are under-appreciating this dynamic.”

Morgan Stanley identified three sectors with more significant potential to create economic value from AI adoption are:

Consumer Staples Distribution & Retail: These areas can benefit from supply-chain optimization, trade dynamics, intelligent product search and personalized pricing. Companies in retail could expand marketplaces and create new high-margin revenue streams.

Real Estate Management & Development: 37% of tasks can be automated, from sales to building management, with the use of virtual assistants and humanoids assisting buyers, renters and hotel guests.

Technology Hardware & Equipment and Semiconductors are the industries likely to show lower impacts.