A new Morgan Stanley study reveals that investors perceive the debt of more inclusive companies as less risky compared with that of less socially conscious firms.

If you think that companies that care about sustainability may be less risky than others, you are not alone. According to a new study from the Morgan Stanley Institute for Sustainable Investing, bonds issued by companies that rank highly on inclusive growth metrics had lower credit spreads and were considered less risky than bonds issued by low scoring peers.

The rankings are based on the Institute’s “Inclusive Growth Score,” which measures how corporations address social and economic disparities in four key areas: human resources, products and services, operations management, and firm management and governance. The higher the score, the greater a company’s efforts to provide widespread opportunity through income, access to healthcare, education and economic advancement regardless of gender, race, ethnicity or geography.

“Our Inclusive Growth Score offers a valuable new quantitative metric to support investors, corporate decision makers and other stakeholders as they pursue a sustainable and resilient post-pandemic global economy,” says Morgan Stanley’s Chief Sustainability Officer Audrey Choi The report builds on 2017 research: “Inclusive Growth: The Anatomy of a Corporation."

Anatomy of a Corporation: Inclusive Growth Drivers and Indicators

Scoring Inclusivity and Risk

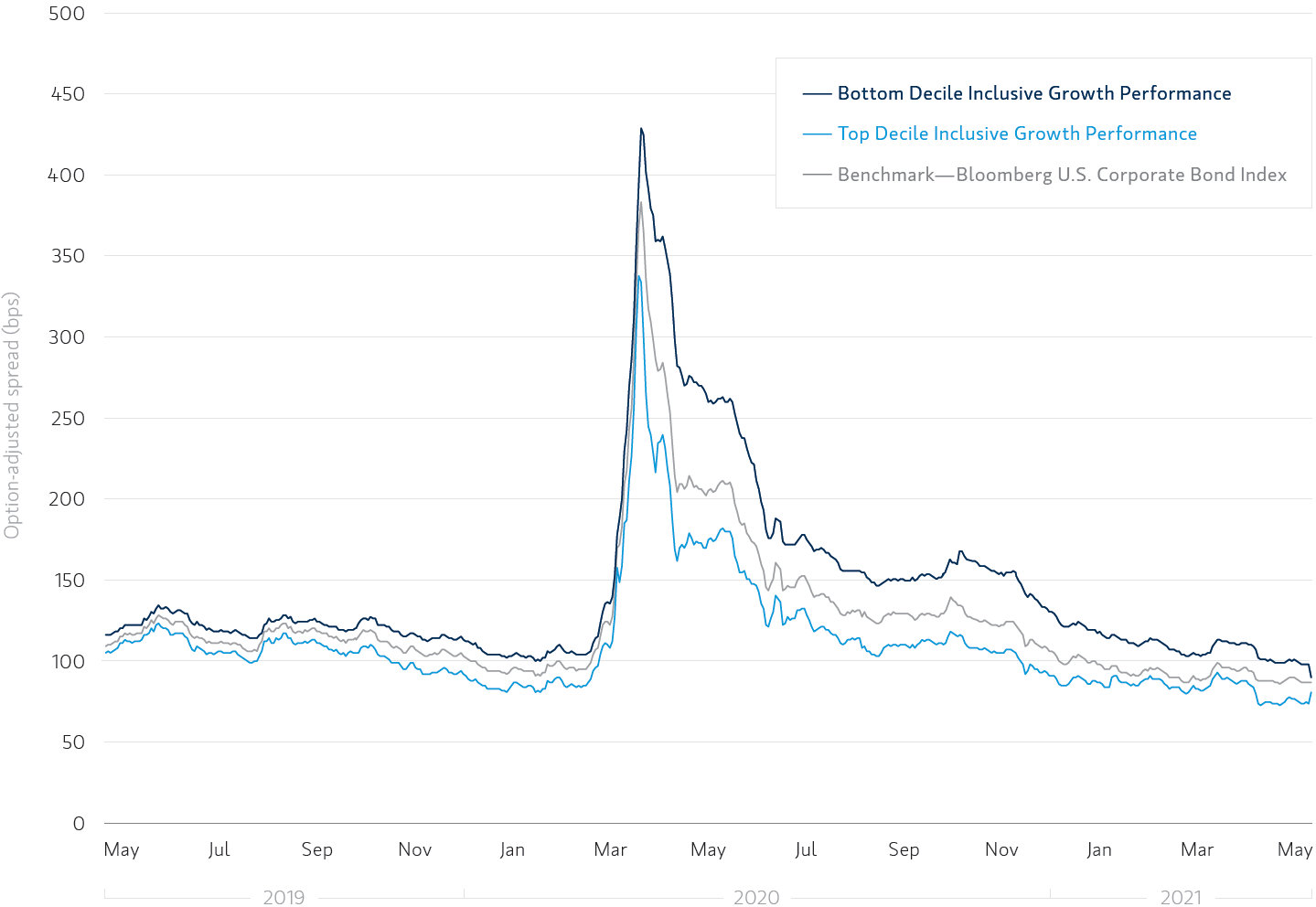

The new study found that the bonds of companies that ranked in the top 10% using the Inclusive Growth Score exhibited lower credit spreads than bonds from companies in the bottom 10% (measured from May 2019 to May 2021). Credit spreads represent the premium that investors require for additional risk associated with the issuance.

Corporate Bond Performance for Top and Bottom 10% of Inclusive Growth Scorers

Prior to the pandemic, credit spreads between high- and low-scoring companies based on the Inclusive Growth Score were relatively small. Then, at the height of market volatility—in March 2020—the credit spread between high-scoring and low-scoring inclusive growth companies widened and showed that investors perceived the former group as less risky. Credit spreads for bonds from companies with the highest Inclusive Growth scores were 146 basis points lower (less risky), on average, than bonds from companies with the lowest Inclusive Growth scores.

The data isn’t the first to show that sustainable investments may offer advantages with respect to risk and performance. In fact, Institute analysis from 2021 shows that sustainable U.S. equity funds and U.S. taxable bond funds outperformed traditional peer funds while exhibiting less volatility. Even over a time horizon of 15 years, sustainable funds showed no difference in performance compared with traditional funds and provided up to 20% less downside risk, according to a 2019 analysis of 11,000 funds.1

The new findings suggest that investors should account for how companies treat stakeholders, such as employees, suppliers and communities as they evaluate risk, Choi says. “The pandemic continues to present companies with unprecedented business challenges, but it also offers the opportunity to drive a more sustainable and resilient global economy through the delivery of more inclusive and equitable workplaces and supply chains, responsible products and services, and transparent and accountable management.”