Artificial Intelligence, Internet of Things and Augmented Reality are about to reinvent how industries utilize data—and could drive an era of productivity growth in our cities, farms, factories and hospitals.

Over the past 10 years, Mobile Internet has dramatically changed how we communicate, shop, learn and invest. It’s almost hard to imagine how humans existed without “like and shares,” streaming TV, and navigation in the palm of your hand.

Now, as the decade of Mobile Internet reaches its apex, a new era is set to begin. A confluence of advanced semiconductor technologies, more pervasive and faster networks, and significant cloud-based data center expansion are driving the next decade of computing: “The Data Era.”

This new Data Era may have already begun and could benefit technology companies—and the market as a whole.

According to a new report from Morgan Stanley Research, this new data-driven computing era will harness such headline-grabbing technologies as Artificial Intelligence, Internet of Things, Blockchain and Virtual/Augmented Reality. Together, these new technologies could drive industries to rethink how they collect, analyze, and act on data across their entire value chains, ultimately driving enterprise productivity growth in our cities, farms, factories, hospitals and trading floors.

The Era of Data Disruption

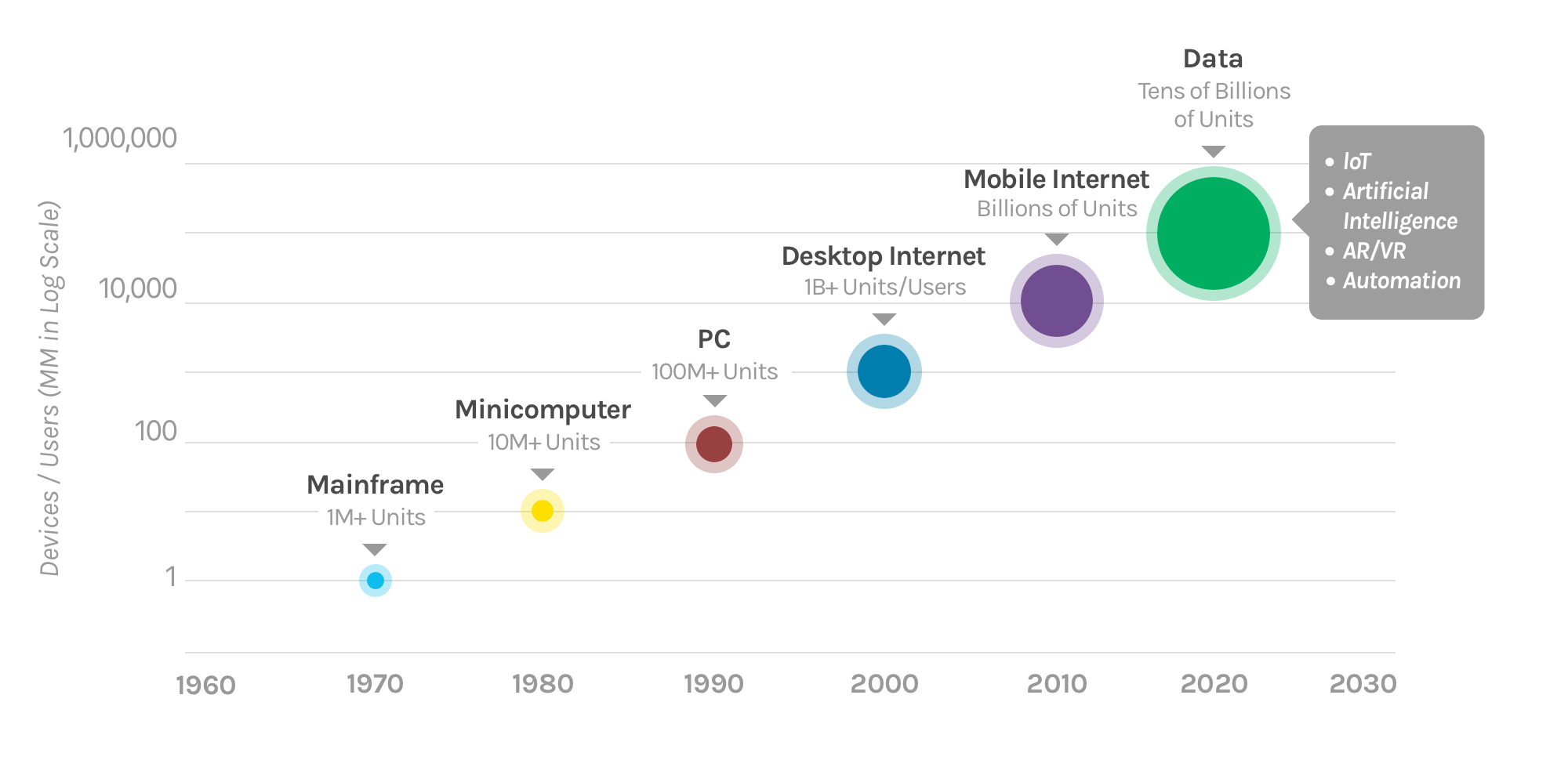

Since the dawn of computing, each 10 year cycle has brought a 10-fold increase in access to compute.

In the 1970s, the mainframe computer helped streamline centralized business functions such as payroll and billing. The 80s and 90s brought a reduction in the size of computers, extending technology to smaller businesses and, for the first time, into the home. In the last two decades, the evolution of the internet began with the desktop then continued to connected devices that fit in your pocket.

Computing Growth Drivers Over Time, 1960-2030E

But according to Katy Huberty, Morgan Stanley’s head of research for the Technology Hardware industry, as the data-era begins, the focus will likely shift from consumer products back to enterprise-level innovations. “The Desktop and Mobile Internet brought 4 billion consumers on line, which drove productivity in how we shop, socialize, and consume content. But, the focus on consumer-oriented technologies over the past two decades coincided with a period of IT underinvestment and declining productivity in enterprises. We now see enterprises reinvigorating their IT spending which will enable greater labor force productivity.”

According to Huberty, these technologies could also save industries trillions of dollars in waste. As enterprises embed data technologies into existing business processes, the potential savings from reductions in inefficiencies, downtime, and human error could be measured in the trillions.

A Focus on Data

At the heart of this new era are data-harnessing technologies that will change how businesses collect, analyze, and act on information.

“This is the first computing cycle in which multiple technologies are emerging at once,” says Huberty. “The Internet of Things connects and collects data from end points, Artificial Intelligence unlocks insights from the growing amount of stored data, Virtual or Augmented Reality allows insights to be viewed in a worker's natural environment, and Automation supplements human work with computers.”

The melding of these technologies could affect almost every sector of the economy and enable new business models.

In health care, problems like misdiagnosis or mistreatment could be prevented, while the length of drug trials could be shortened. In transportation, self-driving car technology could potentially lead to a reduction in traffic congestion and car accidents, resulting in increased productivity. In financial services, data technologies can be applied to risk management, portfolio management and trade clearing, improving efficiency.

The Next Computing Cycle Could Boost Productivity Off Recent Lows

(U.S. Nonfarm Business Sector Output Per Hour, Y/Y)

A Boost for the Enterprise IT Investment Cycle

While these productivity gains will be the long-term driver of sustained IT investment, near-term catalysts are also driving a pick-up in investment. Pent-up demand and clarity on cloud strategies are accelerating technology refreshes after three years of delayed on-premise infrastructure spend. Additionally, recently enacted tax reform could provide an opportunity for stronger earnings, increased cash flexibility, and the ability to expense 100% of capital purchases in year one (accelerated depreciation) which will support incremental IT spending.

Huberty and her team note that in the coming decade, incremental IT investments are estimated to reach $1.6 trillion, compared with an average of $740 billion across the past three computing cycles. Growth in IT investment could accelerate to 5% annually, up from the 2% spent on average over the past 10 years.

Incremental IT Investment Could Double Over Past Cycles

Reshaping the Market

For investors, this new Data Era opens up opportunities to generate alpha since each new computing era often means a change in the leader board.

“Historically, semiconductor firms lead the way in a new cycle,” says Huberty. “With more computers in more devices, and as entire cities and organizations become more connected, the semiconductor industry will remain a dominant technology force.”

Infrastructure providers are usually next to benefit, in areas like networking, storage, servers and surveillance. Finally, value shifts to software and services providers. According to Brian Nowak who covers U.S. Internet companies for Morgan Stanley Research, Internet companies are in a position to leverage the increasing pool of data in new ways. “We believe companies with the largest data sets (users, engagement, purchases, touch points) and the cloud providers are the best positioned Internet companies to capture growth in the Data Era.”

Software services will also benefit as businesses take advantage of AI and machine learning to do tasks humans previously performed. “The incorporation of sensors, actuators and connectivity across the factory floor, into cars and into our homes has massively expanded the digital surface area in which software can optimize business and consumer processes,” says Keith Weiss, Equity Analyst covering U.S. Software. “This drives the need for more software developers, better tools for developing software, and more efficient platforms to develop software.”

The Rising Technology Tide

Finally, the report notes that IT budget, macro and stock market metrics are indicating that this new Data Era may have already begun and could not only benefit technology companies but the market as a whole. Adds Huberty, “As we enter this era, you can view these innovations from a broader market perspective. Technology advantages will likely permeate more and more sectors as the era develops. The winners will be the industry leaders who best leverage data across their entire value chain.”

For more Morgan Stanley Research, on the data era, ask your Morgan Stanley representative or Financial Advisor for the full report, “The Data Era Becomes Investable,” (April 9, 2018). Plus, more Ideas.