By combining your charitable gifts with volunteer efforts, you can have a meaningful impact on the causes you care about, even if you don’t have a lot of money to donate.

How To Give to Charity… If You’re Not a Millionaire

Discover six strategies that can help you amplify your charitable impact, even if you don’t have a lot of money to give.

Key Takeaways

- Charitable giving doesn’t require you to make eight-figure gifts. By donating smaller amounts, and sharing your time and talent, you can make a real difference.

- Make your contributions count by deciding on an annual philanthropic budget and identifying the organizations you would like to support.

- Maximize your contributions by participating in your workplace charitable giving program and exploring the benefits of donor advised funds.

For socially conscious employees who care about giving back, contributing to charity matters. Each year, roughly $5 billion is raised through workplace giving,1 and 86% of employees say they want the opportunity to participate in corporate giving programs.2

Yet, despite the desire to donate, many employees believe charitable giving isn’t for them because they’re not wealthy enough. But you may want to rethink this.

While eight-figure charitable gifts make the news, most donations are much smaller. In fact, many charities would suffer if people didn’t give at lower increments, especially in years of economic uncertainty. Through the power of collective giving, small donations can make a big impact. There really is strength in numbers.

If you’re looking for ways to make a difference, here are a few strategies to consider:

Step 1: Find Your Focus

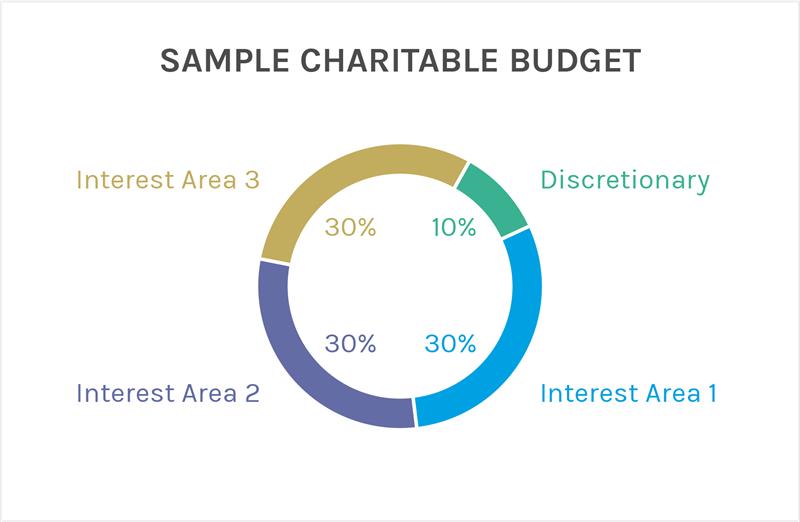

No matter what you’re passionate about, chances are there’s a charitable cause that aligns to your interests. Do you care about the arts? Civil rights? The environment? Think through the type of impact you’d like to make and identify one to three core areas you’d like to focus on.

Beyond your “official” areas of interest, consider setting aside 10% of your charitable budget for discretionary giving. This may include supporting a friend’s cancer research walk-a-thon even if health isn’t your focus area, or perhaps donating to your alma mater even if education isn’t a top priority. You can also use this part of your giving budget to donate to one-time events that require community support, like natural disaster relief.

Step 2: Think About the Three Ts

Set your philanthropic budget early in the year. That includes money, as well as time and energy. Your philanthropic resources will likely fall into three main buckets:

1. Time: The hours you can dedicate to volunteer work

2. Talent: The specialized skills you can offer to an organization

3. Treasure: The money you’re able to donate

In addition to contributing “treasure,” think through ways you can contribute your time and talent. If you’re a computer engineer, for instance, you might help a nonprofit with its technology. If you work in marketing, you might review new capital campaign brochures. If you work in finance, you might help develop a budget for a fundraiser.

If you do choose to donate talent, be open from the outset about how much time you can dedicate. Roughly one-third of the nonprofit workforce is volunteers,3 and charities need to be able to understand how to best deploy those resources based on their availability.

Step 3: Make a List of Organizations

Compile a list of interesting organizations you would like to support. Depending on your focus areas, you may want to cast a wide net. For example, if you care about international aid, compile a list of organizations across a spectrum—such as refugee assistance, disaster relief, medical aid, human rights advocacy or education reform—and then decide what resonates most with you.

Great resources include Candid and Charity Navigator, where you can learn about each charity’s programs, size, impact, awards, financials and more. Aim to identify five to 10 target organizations, so you have a robust list to whittle down.

Step 4: Reach Out

Nonprofits rarely say no to speaking with someone interested in learning more, even if that person is not a big-money donor. Plus, a lot of organizations recognize that younger donors, especially, offer fresh perspectives, diverse skill sets and—perhaps most importantly—broad personal and professional networks where they can spread the word.

Once you identify who to reach out to, which you can do with some online research, ask each charity about its short- and long-term goals. What progress has it made toward its goals so far? Does the organization seem trustworthy? Do its programs make sense to you? Does it seem well-run and organized?

Step 5: Define the Details

Identify specific programs you’re interested in supporting and think about the size of your gift or time commitment. For instance, you might allocate an annual monetary gift to one organization and offer a specified number of hours each month to another.

One giving option that has been growing in popularity4 is donor advised funds (DAFs). DAFs allow you to donate cash or other financial assets to a fund that is typically managed by a public charity. What makes them unique is that you get to recommend how your funds will be allocated to your chosen charities over time, while becoming eligible to receive a tax deduction5 in the year you make the donation. This makes them great choices if you plan to give to charity before the end of the year but need time to decide where to direct your funds.

Step 6: Amplify Your Impact

Whether you are giving time, talent or treasure, there may be ways for you to give more than you think. That’s especially the case if your employer offers paid time off for volunteering, matches employee charitable donations or sponsors a charitable giving program. Employers can also boost philanthropic outcomes by sponsoring year-round giving programs, forming partnerships with nonprofits and enabling employees to open their own individual giving accounts.

If you’re not sure what your company offers, be sure to ask: 65% of Fortune 500 companies offer matching gift programs,6 and 61% of companies match employee volunteer service hours with monetary donations.7

By sharing your passion about the causes that matter to you, you can help make a bigger difference than you expect.

1 America’s Charities, 2024. “7 Facts About Workplace Giving Effectiveness.”

2 Benevity, July 24, 2024. “9 Best Practices to Engage Your People in Granting For More Impact.”

3 Double the Donation, 2024. “Essential Volunteer Statistics and Trends in Engagement.”

4 Forbes, June 12, 2024. “Will 2024 Be The Year Of The DAF?” by David Hessekiel.

5 This deduction is only available if a donor elects to itemize their deductions.

6 Double the Donation, 2024. “Corporate Giving and Matching Gift Statistics [Updated 2024].”

7 getconnected by Galaxy Digital, April 16, 2024. “10 Corporate Volunteerism Statistics for Companies,” by Eli Samuels.

The Morgan Stanley at Work Charitable Giving Program leverages the Morgan Stanley Global Impact Funding Trust, Inc. (“MS GIFT, Inc.”), which is an organization described in Section 501(c) (3) of the Internal Revenue Code of 1986, as amended. MS Global Impact Funding Trust (“MS GIFT”) is a donor-advised fund. Morgan Stanley Smith Barney LLC provides investment management and administrative services to MS GIFT.

While we believe that MS GIFT provides a valuable philanthropic opportunity, contributions to MS GIFT are not appropriate for everyone. Other forms of charitable giving may be more appropriate depending on a donor’s specific situation. Of critical importance to any person considering making a donation to MS GIFT is the fact that any such donation is an irrevocable contribution. Although donors will have certain rights to make recommendations to MS GIFT as described in the Donor Circular & Disclosure Statement, contributions become the legal property of MS GIFT when donated.

The Donor Circular & Disclosure Statement describes the risks, fees and expenses associated with establishing and maintaining an MS GIFT account. Read it carefully before contributing.

Morgan Stanley Smith Barney LLC ("Morgan Stanley"), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

© 2025 Morgan Stanley Smith Barney LLC. Member SIPC.

CRC#4068169 (12/2024)